Income protection insurance is designed to provide benefits if you are unable to work for a significant period of time due to injury or illness. This is particularly important for contractors and self employed tradies, who may not have access to the benefits that regular full time employees have. The maximum benefit paid is usually 75% of your income, which is generally paid monthly once your illness or injury has been confirmed and after any qualifying period.

Having income protection insurance is an extremely good idea, not just to safeguard yourself in the event of an injury or illness, but to provide financial protection for your family, particularly if you are the main income earner. Choosing the right policy can be daunting and many people may be tempted to choose the cheapest but this might not provide enough cover for your needs. Trying to save money by choosing a policy that won’t provide sufficient cover for you if you do need to make a claim, could turn out to be a false economy.

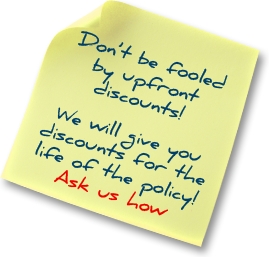

Your best bet when looking for the right income protection insurance may be to consult a broker or financial advisor. There are a large number of products on the market and an experienced advisor will be able to speak to you about the ones mostly likely to be suitable for your situation and those that offer the best value for money.

Income protection insurance is one of the two main forms of insurance that tradies need. Having income protection cover is often a requirement before you are allowed on a work site, so it is important to have an understanding of how it works and how it may benefit you.

Income protection insurance is one of the two main forms of insurance that tradies need. Having income protection cover is often a requirement before you are allowed on a work site, so it is important to have an understanding of how it works and how it may benefit you.