Building resilient portfolios through diversification

By Greg Davis, President and Chief Investment Officer, Vanguard

Investing Strategy

Vanguard’s President and Chief Investment Officer, Greg Davis, examines the role that asset classes play in a portfolio in today’s market environment.

After a period of relative market calm, market dynamics in the last few years have called into question the viability of traditional allocation models like 60% shares / 40% bonds and the conventional roles of asset classes. Cash delivered record returns, bonds fell in tandem with shares in 2022, and U.S. equities continue to outpace equities in other developed markets. The speed at which the landscape changed, as central banks attacked inflation with higher interest rates, serves as a strong reminder of why investors need to resist the temptation to chase performance and why portfolio diversification remains as important as ever.

Equities

U.S. equities have contributed to much of the overall market performance since the global financial crisis in 2008–2009, but the drivers of that outperformance over the last decade have likely sown the seeds for more muted performance over the coming one. With stretched valuations and a slowdown in earnings growth, we’re forecasting annualised returns of 3.8%–5.8% in the U.S. equity market over the next decade. Investors should be cautious with U.S. equities, considering the expensive valuations and lower expected growth. By comparison, we anticipate returns of 6.9%–8.9% annualised over the next decade for international equities because of the multidimensional growth opportunities given lower volatility, cheaper valuations, and higher potential for growth.

Fixed income

Historically, bonds have served as a stabiliser for a portfolio because there’s usually less volatility risk in fixed income than in equities. Over the past decade or so, investors shied away from bonds in favour of cash and cash equivalents. But bonds and cash serve separate and distinct purposes. Over the long term, high-quality bond funds have tended to offer better diversification against stock volatility and higher yield potential than cash. While replacing bonds with cash may work in the short term, investors need to consider more than just yield if they want to design an all-weather portfolio.

Current economic conditions have made fixed income a more viable asset class that can grow over time and compound your returns for medium to long term savings needs. Global bond markets have repriced significantly over the last two years as interest rates increased, putting bond valuations close to fair. We expect global bonds to return a nominal annualised 3.9%–4.9% over the next decade. It’ll remain important to diversify because international bonds can mitigate overall volatility and improve portfolio outcomes through lower correlations.

Cash

Investors should think of cash as the tool to manage liquidity risk— it can be a strategic allocation for day-to-day needs, for emergency savings, or for those with a very low risk tolerance. Cash should not be considered a substitute for shares or bonds in any market environment, even in the current high interest rate environment, where investors have been able to get a real return on cash.

On the face of it, shifting your portfolio to cash seems like a good idea in this environment: There is no risk in cash and you’re getting the same return you might from bonds—for now. But cash is limited in its ability to keep up with inflation and investing in cash means forgoing risk premium. Investors must also consider the durability of the yield, which is anchored to monetary policy. If central banks cut interest rates, the yield on cash decreases, and you’ll miss out on the income you would have earned if you had maintained your target bond allocation.

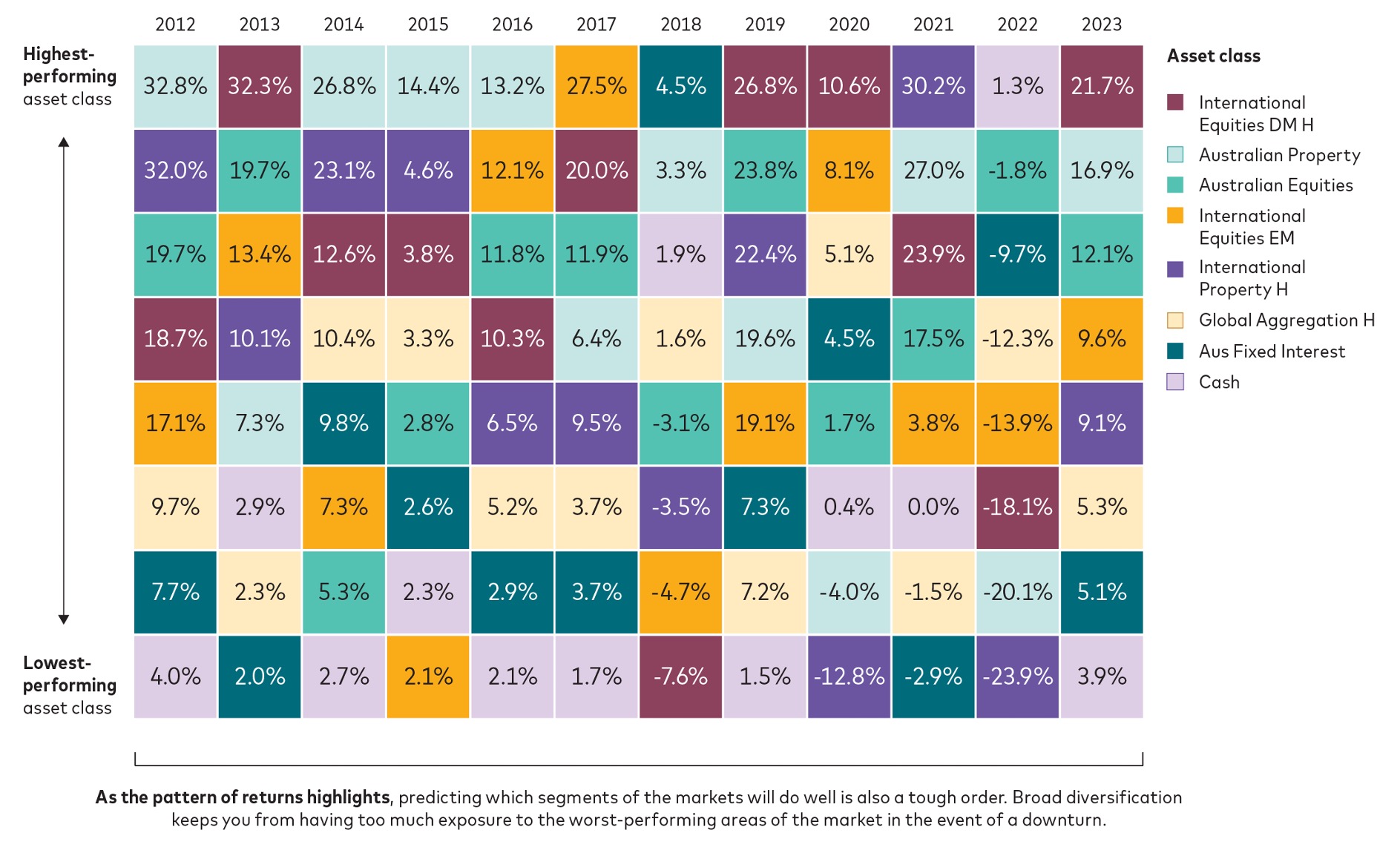

The current economic and market environment is primed to tempt investors to consider forgoing their strategy in order to chase returns. But across and within asset classes, we can’t account for everything, such as how an AI-led productivity boom or geopolitical events could affect returns. Market leadership is not guaranteed, and chasing returns can leave investors exposed to unnecessary volatility and risk.

Our research shows that a balanced mix of diversified assets, combined with a disciplined, cost-conscious approach to investing, can help improve investors’ chances of achieving their long-term investment goals, as long as they stay the course.

Annual asset class returns for the year ended December 2023

Source: Vanguard Investment Strategy Group analysis as at 31 December 2023 using index data from Bloomberg, FTSE, MSCI, S&P & UBS.

Notes: Australian equities is the S&P/ASX 300 Index; Australian Property is the S&P/ASX 300 A-REIT Index; International Property Hedged = FTSE EPRA/NAREIT Dev x Au Hedged into $A from 2013 and UBS Global Investors ex Australia AUD hedged Index prior to this; International Shares Hedged is the MSCI World ex-Australia Index Hedged into $A; Emerging Markets Shares is the MSCI Emerging Markets Index; Australian Bonds is the Bloomberg Ausbond Composite Bond Index; Global Aggregate Bonds = Bloomberg Global Aggregate Index Hedged into $A; Cash = Bloomberg AusBond Bank Bill Index.

Past performance is no guarantee of future returns. The performance of an index is not an exact representation of any particular investment, as you cannot invest directly in an index.

IMPORTANT: The projections or other information generated by the VCMM regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results, and are not guarantees of future results. Distribution of return outcomes from the VCMM are derived from 10,000 simulations for each modelled asset class in AUD. Simulations are as of 31 December, 2023. Results from the model may vary with each use and over time.

The VCMM projections are based on a statistical analysis of historical data. Future returns may behave differently from the historical patterns captured in the VCMM. More important, the VCMM may be underestimating extreme negative scenarios unobserved in the historical period on which the model estimation is based.

The Vanguard Capital Markets Model® is a proprietary financial simulation tool developed and maintained by Vanguard’s primary investment research and advice teams. The model forecasts distributions of future returns for a wide array of broad asset classes. Those asset classes include U.S. and international equity markets, several maturities of the U.S. Treasury and corporate fixed income markets, international fixed income markets, U.S. money markets, commodities, and certain alternative investment strategies. The theoretical and empirical foundation for the Vanguard Capital Markets Model is that the returns of various asset classes reflect the compensation investors require for bearing different types of systematic risk (beta). At the core of the model are estimates of the dynamic statistical relationship between risk factors and asset returns, obtained from statistical analysis based on available monthly financial and economic data from as early as 1960. Using a system of estimated equations, the model then applies a Monte Carlo simulation method to project the estimated interrelationships among risk factors and asset classes as well as uncertainty and randomness over time. The model generates a large set of simulated outcomes for each asset class over several time horizons. Forecasts are obtained by computing measures of central tendency in these simulations. Results produced by the tool will vary with each use and over time.

This article contains certain ‘forward looking’ statements. Forward looking statements, opinions and estimates provided in this article are based on assumptions and contingencies which are subject to change without notice, as are statements about market and industry trends, which are based on interpretations of current market conditions. Forward-looking statements including projections, indications or guidance on future earnings or financial position and estimates are provided as a general guide only and should not be relied upon as an indication or guarantee of future performance. There can be no assurance that actual outcomes will not differ materially from these statements. To the full extent permitted by law, Vanguard Investments Australia Ltd (ABN 72 072 881 086 AFSL 227263) and its directors, officers, employees, advisers, agents and intermediaries disclaim any obligation or undertaking to release any updates or revisions to the information to reflect any change in expectations or assumptions.

© 2024 Vanguard Investments Australia Ltd. All rights reserved.