Given wealthy people try never to sell property, the proposal by the ALP to change negative gearing and CGT is a highly inefficient tax in its equity and fairness, although simple with many unintended consequences.

So what were Labours simple policies from 1/1/2020

- Negative gearing limited to newly built housing

- CGT for assets held longer than twelve months reduced from 50% to 25%

This simple although economic in-efficient in equity and fairness would have had a negative outcome, discouraging people from investing in their futures. Wealthy people already pay 45% tax.

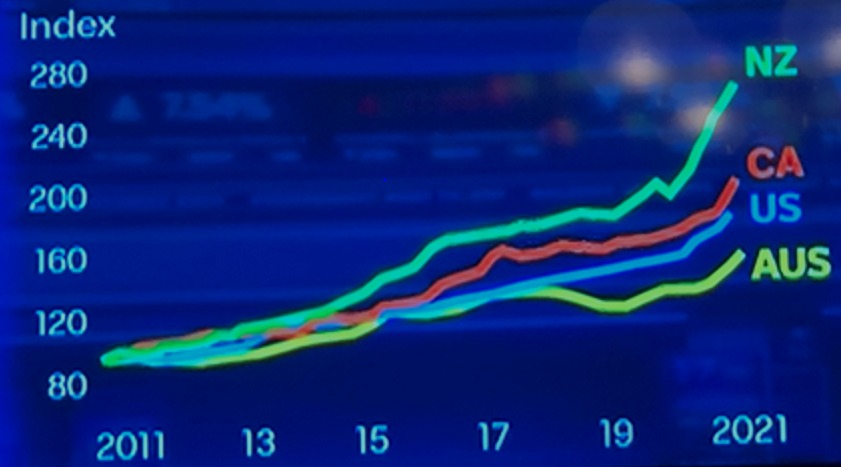

New Zealand (NZ) introduced similar reforms and have not had the impact the government intended as there other forces at play other than just simple tax incentives or disincentives. Recently, NZ have had a 23% (outpacing the world)

(“”Coronavirus Impact Chart Pack 2021-09-04,” 2021)

increase in property prices with Prime Minister Jacinda Ardern quoting there is no silver bullet to reforms for property prices – including her tax reforms. (Hunt, 2021).

So what are the NZ reforms (Fotheringham and Cunich, 2021):

- Residential property acquired on or after 27th of March 2021; held for 10 years (previously five years) no CGT.

- Interest cannot be claimed. Existing investors will phase out over four years to the 1st of April 2025.

- New builds only have to be held for five years, and no tax is payable on sale.

- From 1/5/201, investors can only borrow up to 60% loan value ratio.

Although it is important to note there are some significant differences in policies between NZ and Australia, in particular, these are: (Fotheringham and Cunich, 2021)

- Stamp duty and CGT is not applicable in NZ, unlike Australia stamp duty is payable in all states, with some states offering concessions

- NZ property owners don’t pay rates to councils or local authorities.

- Land tax is exempt for both countries for residential properties

- NZ No Payroll and Health tax

- NZ GST at 15% Vs Australia at 10%

- Both pay income tax

So, whilst NZ and Australia are similar, there are differences in our underlying tax system. NZ is more generous in other areas and has no existing stamp duties (disincentive to sell in Australia) etc. All encouraging and fuelling property prices.

NZ tax changes have not curtailed property price growth as numerous other factors increase demand and create higher prices. A significant factor (seen in all asset bubbles) is low-interest rates, fiscal stimulus, lockdown savings fuelling deposit and above all else limited housing stock always a major contributing factor to rising prices, which all increase consumer sentiment of a robust recovery all contributing to property price growth.

The NZ government’s attempt to try and rain in property price growth with new taxes to stop flipping activity has not worked. (Menon, 2021) and would not have worked in Australia.

As seen with ALP’s 2019 election demise, playing with property tax is political failure (Menon, 2021). John Hewson Liberal party also found this out when he tried to introduce GST in an unclear way.

ALP own review of pursuing bold new property tax measures to fund their spending was an overwhelming change for voters. Finding 39 found that low-income voters swung against Labour indicates that removing property tax incentives was not the right decision – aspiring Australians.

Labour conceded their policies were too left-wing, attacking the big end of town. For every winner, there would be a loser (Robin Hood mentality), which was a complete backlash by all aspiring Australians who primarily immigrated to Australia looking to create a better life.

Voters aged 25 -34 years living in the outer suburbs and regional areas swung against Labour (supposed to benefit from these policies reduce pressure on residential property prices). (Emerson, 2019) Page 55 & 56

Labour argues that removing negative gearing on older stock will allow aspiring first home buyers to purchase their preferred property and not compete with investors based on their data that 93% of new property loans go to buying older properties. Although this fact is impossible to determine, and the ABS doesn’t collect this data. (Hughes, 2019)

ALP argued they want to limit negative gearing to newly built housing stock, which would be simple to administer and seem to be fair and equitable. Furthermore, Investors could continue to claim deprecation, unlike older properties which is a current policy.

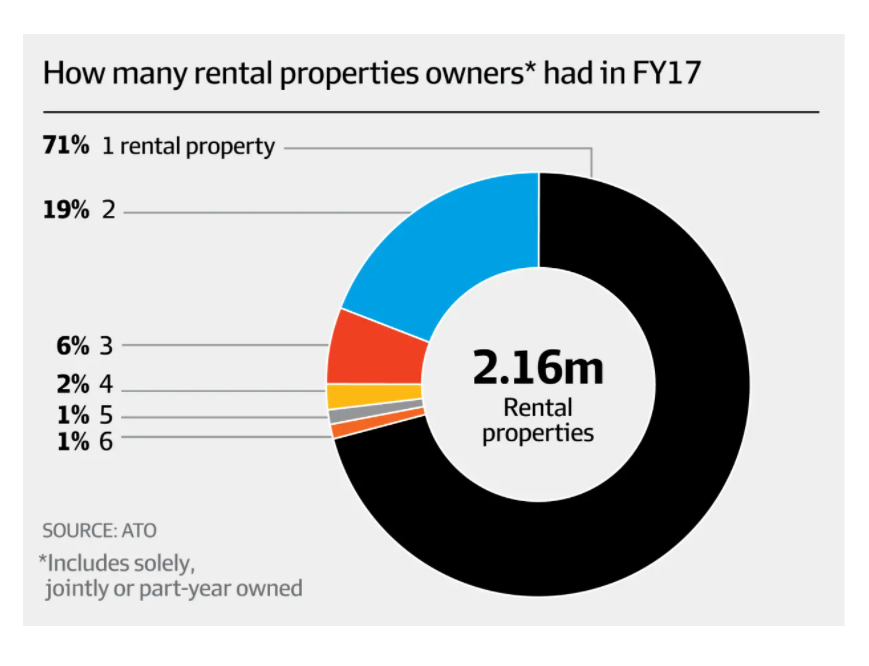

Although on balance, I would suggest this to be inefficient and create unnecessary complexity for mum and dad investors, the majority of investors in residential property at 2.1 million households. (“Homeownership and housing tenure,” n.d.)

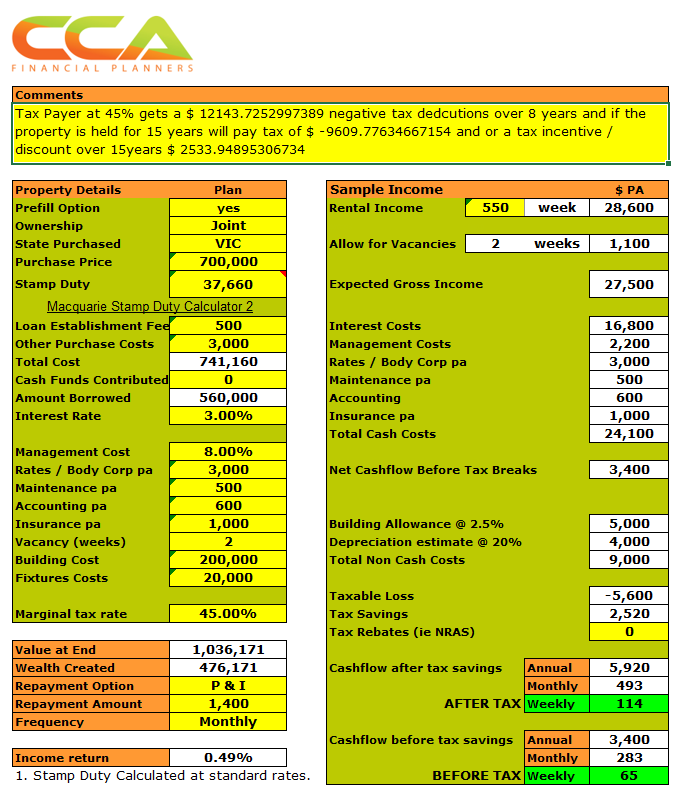

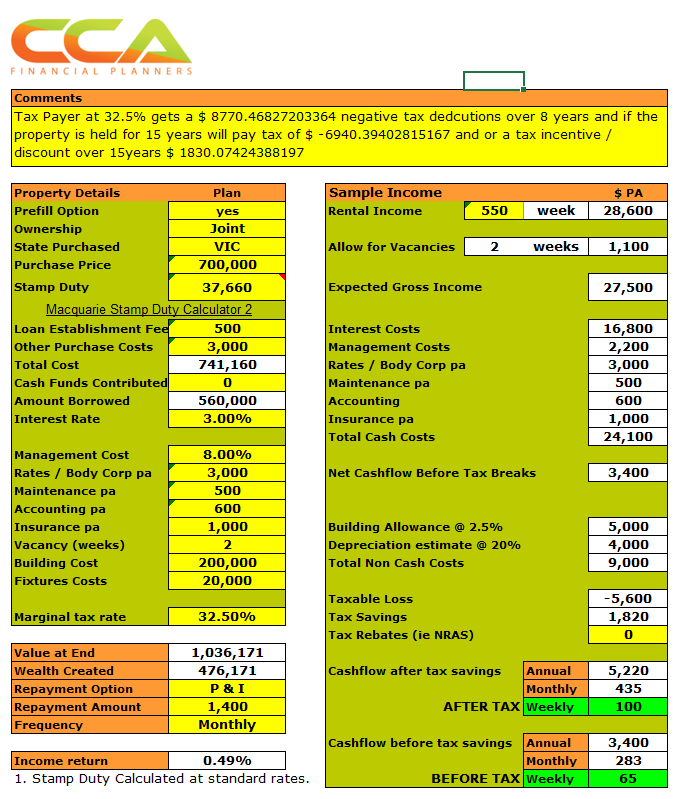

My analysis highlights an average $700k residential investment property change from negative to positively geared is around eight years for all taxpayers. When a property is owned over 15 years, the incentive is under $3k for all taxpayers. Appendix 1 & 2

So why create this political noise for such a short period and possibly disrupt the investors who support 2.1 million renters.

If we create complicated tax laws that aim to discourage property investors, the unintended consequence that given the vast majority of renters rent from a private landlord would be to potentially discourage to provide rental properties and move their money to other asset classes like shares or worst still they don’t invest at all.

ALP policies were not fair or equitable as commercial enterprises who provide residential domestic housing could still claim negative gearing and capital gains tax discounts (although likely to be OI) given its in there ordinary course of business.

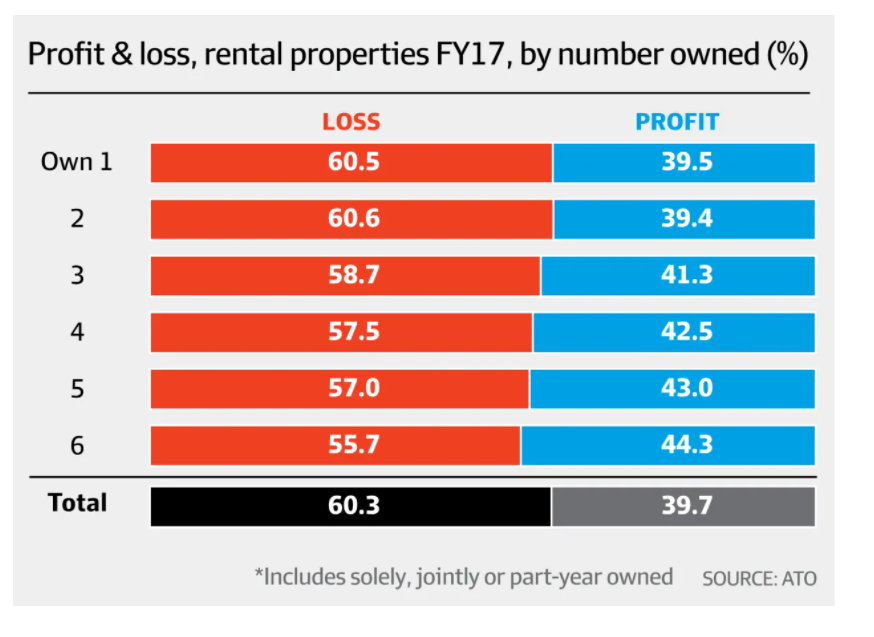

The ATO data shows 2.2 million landlords are negatively geared fell to 60 per cent in 2017, the lowest level since 2003 and 1.3 million landlords made rental losses while 855,975 were natural or made a gain. (Mather and Tadros, 2019)

My own data supports that when properties are held for more than 8 years, they become positive or profit territory.

The other argument that the current system is not fair as it favours the wealthy is flawed. 71% of landlords own only 1 property, with only 10% of landlords owning more than 3 (deemed wealthy ) are getting an unfair advantage of the tax pool. (Hughes, 2019)

The data indicates it’s mainly Mum and Dad investors investing in residential real estate as it’s within their comfort zone (it’s what they know and trust) and within their investment experience.

If you limit incentives or make it too complicated, these investors will pull out of the market. The unintended consequence would be for less stock, subsequently pushing up rents. This would then reduce the time any property produces negative results, which supports there is no need not to introduce a reduction in negative gearing benefits.

Introducing these reforms will create a disincentive for mum and dad Australians is a fundamentally flawed tax. If investors withdraw from investing, they will initially pay more personal income tax, which will be at the cost of paying pension sooner. Given no other investment experience they are likely to spend their money instead and rely on government support when they exhaust their retirement savings.

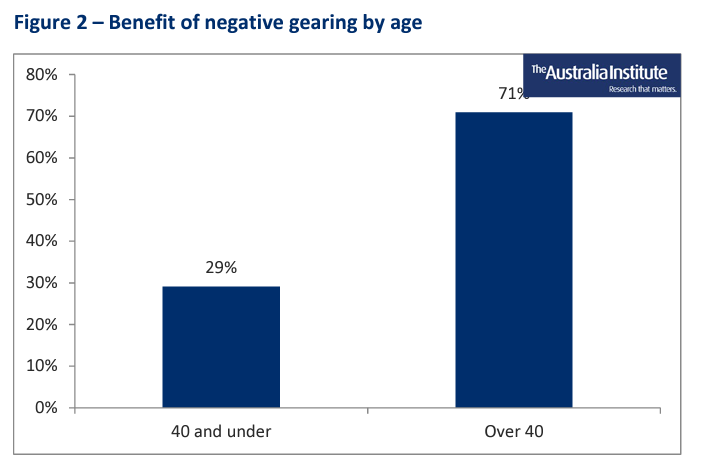

The Australian institute highlighted that the biggest losers from negative gearing are the young by preparing the following analysis:

From my financial planning practice, its only once clients gain equity in their home which they use as a deposit for the investment, that they are usually above age 40. The above analysis is flawed, showing that it’s the older people who benefit from negative gearing.

It’s only when older Australians start planning for their future (for most after they have purchased a home and have a couple of kids) that they start investing in creating housing stock for younger Australians to rent. The system works very well, with one generation supporting the next as they progress through life.

My client base supports the view that most investors who negatively gear aren’t those on high incomes, but everyday Mum and Dad investors. These are the people most likely to be adversely affected by Labour’s proposed negative gearing policy change.

Labour’s policy seems simple, fair, and equitable, given existing properties would be grandfathered. However, the unintended consequences would be for existing property owners to hold and retain the property for more extended periods than would otherwise.

This would create further shortage and supply of property on the market and further increase price growth.

Again, this supports that wealthy people don’t sell (given the disincentive to sell), so reducing capital gains is again of no consequence ( as it is a tax on realised gain). These properties are held for the long term. They end up positively geared.

Our property tax system encourages properties to be held and even unused, further exaggerating the shortage and supply of housing and property on our markets. Capital gains tax is a clear disincentive to sell. Given banks now will release equity on the property, further encouraging property holders to access funds via a loan and further reducing the supply of property on the market.

Our system of title ownership in a landlocked economy will always lead to a boom-bust cycle as people compete for limited land/property supply. The significant factors being interest rates, scarcity of land, and lastly, I would suggest property taxes incentives are the factors that are driving up property prices. Our property ownership system needs a massive overhaul. Given significant change is political suicide unless we get authentic leadership on both sides that agree this boom bust cycle will continue, irrespective of property taxes.

References

”Coronavirus Impact Chart Pack 2021-09-04 [WWW Document], 2021. . Saul Eslake Econ. URL https://www.saul-eslake.com/coronavirus-impact-chart-pack-2021-09-04/ (accessed 9.11.21).

Emerson, D.G., 2019. Review of Labour’s 2019 Federal Election Campaign.

Fotheringham, D.M., Cunich, J., 2021. New Zealand Housing investment tax changes explained. Aust. Hous. Urban Res. Inst.

Home ownership and housing tenure [WWW Document], n.d. . Aust. Inst. Health Welf. URL https://www.aihw.gov.au/reports/australias-welfare/home-ownership-and-housing-tenure (accessed 9.5.21).

Hughes, D., 2019. ALP’s negative gearing policy based on “dodgy data.” Aust. Financ. Rev.

Hunt, E., 2021. New Zealand moves to rein in runaway housing market with billion dollar plan [WWW Document]. the Guardian. URL http://www.theguardian.com/world/2021/mar/23/new-zealand-moves-to-rein-in-runaway-housing-market-with-billion-dollar-plan (accessed 9.5.21).

Mather, J., Tadros, E., 2019. Negatively geared landlords lowest in 14 years. AFR.

Menon, P., 2021. Cooling measures doing little to slow New Zealand’s housing boom. Reuters.

Appendix:

1) Taxpayer at 32.5% only receives $1830 tax incentive.

Received $8770 in negative tax deductions over 8 years. Over 15 years taxpayer will pay $6,940 in tax. Over a 15-year period will receive $1,830 in tax incentive.

2) Taxpayer at 45% only receives $2,533 tax incentive.

Received $12,143 in tax deductions over 8 years. Over 15 years taxpayer will pay $9,609 in tax. Over a 15-year period will receive $2,533 in tax incentive.