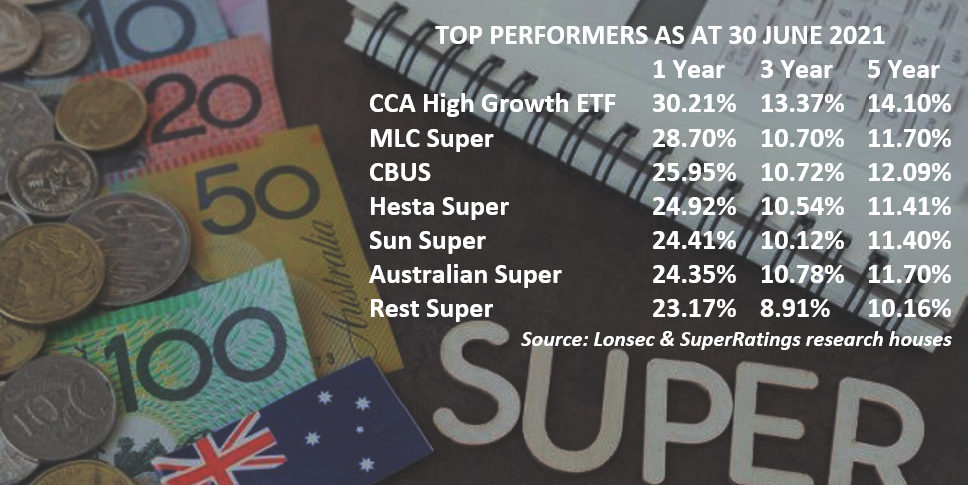

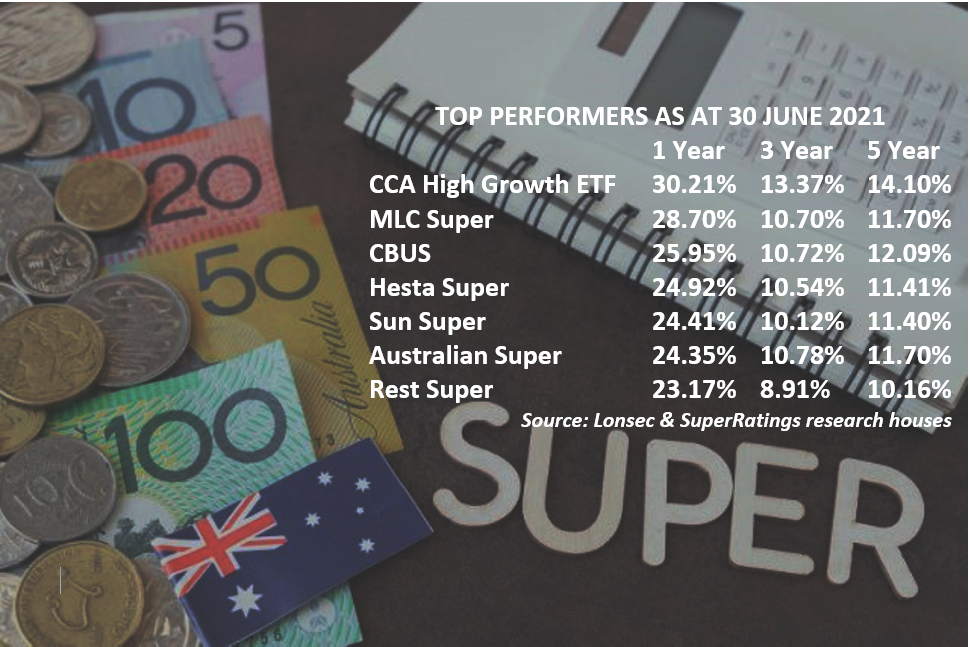

Top Performing Superannuation Funds in Australia – Guess who outperforms again over 1, 3 and 5 years

Once again, following the start of a new financial year, we have been working hard behind the scenes to gather all of the data to compare the Top Performing Superannuation Fund Returns in Australia for the 30th of June 2021, as well as our super robust solutions against the market, just as we did last year.

The year to June 2021 will go down as one of the better periods for the share market in recent times. At +28% returns, it ranks alongside some of the very best since the All ordinaries began. It’s worth noting the average annual return over that period has been 10.4%. The US market is up 15% this year which is almost as much as it rose in 2020.

We can expect a correction which will be healthy for all markets, although I’m not sure what will be the trigger. Statistically, markets produce highs in August and September, with lows in October and November. I suggest 2021 will be no different given the easy money supply and printing around the world.

In any event, that’s a bumper year for returns, especially set against a backdrop of Covid created panic and economic distress.

This highlights what our tailored approach of applying a low-cost, passive investment style to our client portfolios can achieve with continued good quality advice, when compared to low-cost active management funds such as industry super funds.

Here are the results.

NB: The above figures are net of investment manager fees and is based on a High Growth risk profile. Data has been confirmed from each super fund website. Past performance is not a guarantee of future performance. Also note, Uni Super results were not published as of today’s email.

The ancient Chinese philosopher Confucius once said, “Success depends upon previous preparation, and without such preparation there is sure to be failure.”

My commitment as an adviser is to always stay ahead, learn and apply rigorous testing to any strategies we recommend to our clients. Before recommending our ETF investment range, I individually invested in and tested our portfolio, and I have an absolute conviction that our strategies are robust and market leading. See my October 2019 interview in New York at SP Dow Jones indices offices.

Further to this, our investment strategy contains the following features;

- Improved risk management – ETFs spread across regions consequently reducing risk

- Reduced Cost – Investment fees for our ETF portfolios are as low as 0.18% pa vs most industry/retail actively managed funds which are at an average 0.75% pa

- Guaranteed reduced cost as a result of removing conventional asset rebalancing when you are in a taxable position

If we haven’t already spoken to you about the benefits of Exchange Traded Funds (ETFs) we are aiming to do so at your next annual review. Alternatively, please feel free to reach out earlier if you wish to discuss sooner to determine if it is appropriate for your circumstances.