Are you retirement ready? Our inaugural How Australia Retires study has uncovered some common themes that make Australians highly confident about their retirement.

How confident are you about your future retirement?

Do you think you’ll have enough money to achieve the retirement lifestyle you imagine?

And, importantly, what steps are you taking if any, or have you already taken, to help ensure you do?

They’re all key questions, and it’s evident from major retirement research that Vanguard has undertaken that Australians with the highest confidence about their future retirement tend to take the most purposeful action to prepare.

This may include accessing financial advice, having a detailed plan, and making regular extra contributions to their superannuation.

These are some of the key findings of Vanguard’s inaugural How Australia Retires study, which follows a survey of more than 1,800 working and retired Australians aged 18 years and older.

The aim of the study was to better understand the way Australians across different age groups feel towards their retirement, how they prepare for their retirement, and the role that superannuation plays in that preparation.

Among other things, we found that people with the lowest confidence about their retirement tend to be the least actively prepared.

Often they have never accessed financial advice and have little understanding of how they can achieve their retirement goals. They also expect to be more reliant on the government’s Age Pension after they retire than those with higher retirement confidence.

Preparation and planning

Interestingly, our research has found that having high retirement confidence is not dependent on age or income, but rather on having a plan.

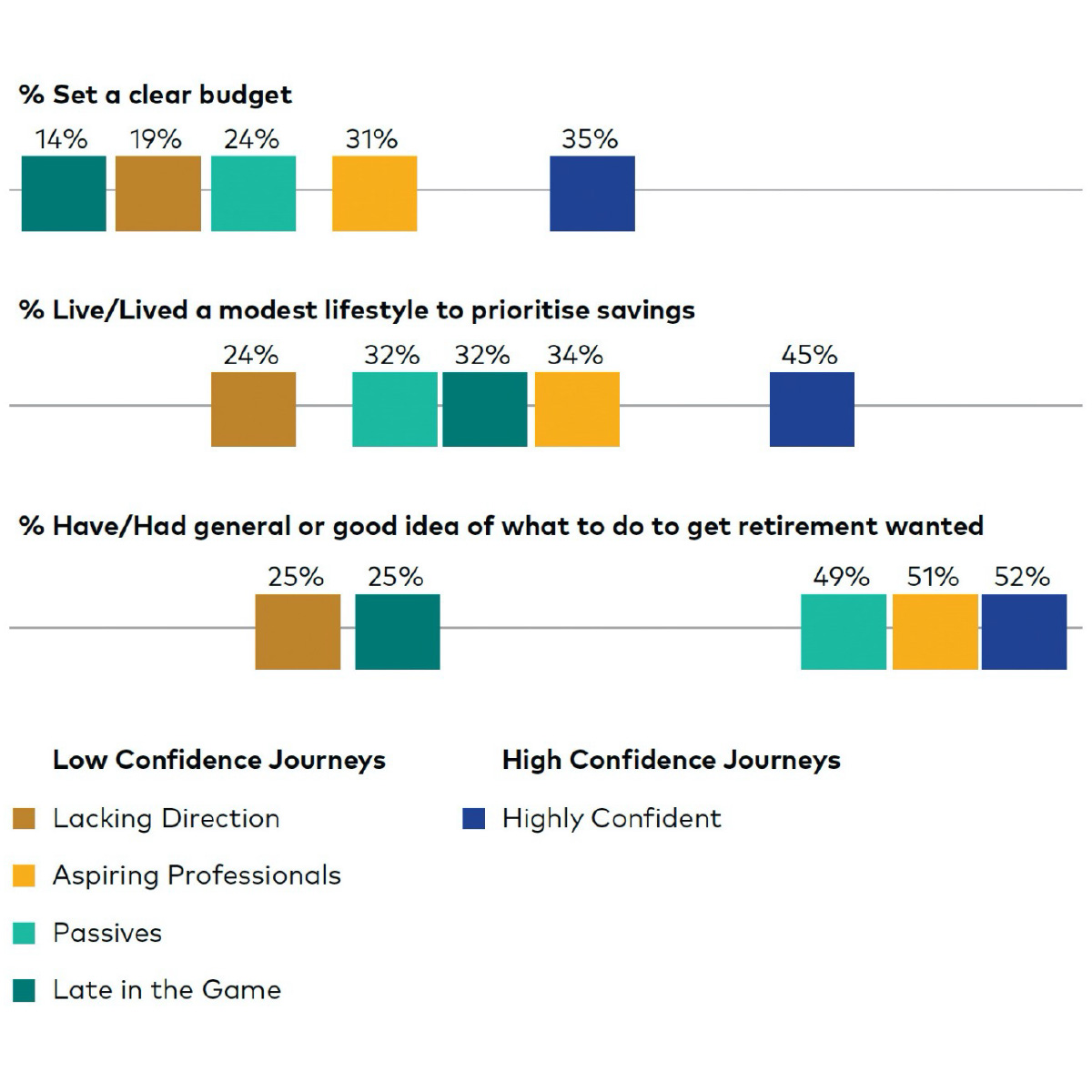

More than half (52%) of the people we surveyed who presented themselves as being highly confident about their retirement readiness feel that they know what they need to do to achieve the retirement outcome they desire and are optimistic about this phase of their life.

They are relatively likely to use budgets and prioritise their savings.

Source: Vanguard

On the other hand, most Australians surveyed who presented as having low confidence about their retirement readiness do not have a plan and feel the most unprepared.

They do not tend to make regular additional super contributions and are generally less optimistic and more likely to feel disinterested, anxious or worried about this later phase of life.

Among the Australians surveyed who are generally older and who have typically taken less action to prepare, only 27% feel optimistic about retirement and just 23% feel very confident.

Many are concerned about not having enough income in their retirement and are uncertain about the actions they could take to achieve the retirement they envision.