Beating the market is much harder than you think

By Tony Kaye, Senior Personal Finance Writer

Investing strategy

The latest SPIVA results highlight the benefits of index funds as portfolio cores.

“Don’t look for the needle in the haystack. Just buy the haystack”.

That’s a famous quote by Vanguard’s founder, John Bogle, that really sums up why it’s so hard for any investor, even the professional active stock pickers, to beat the returns from a share market.

The portfolio managers of actively managed funds typically hand-pick stocks to put into their funds in the belief they will deliver higher returns than the share market. By contrast, index fund managers such as Vanguard invest in all of the companies within a specific share market index so investors can capture the market’s total return.

Finding companies that will deliver better returns than the broader share market is fairly similar to hunting for needles in a haystack. Don’t expect to find them.

That’s borne out in new data just released by S&P Dow Jones Indices that’s contained in its SPIVA Australia Focus Mid-Year 2024 Scorecard. SPIVA stands for S&P Indices versus Active and it measures the performance of actively managed funds relative to their assigned index benchmarks over various time horizons.

The latest SPIVA report is a six-month snapshot of active managers’ performance, although the report also looks at their performance over one, three, five, 10, and 15 years.

Most active fund managers are not talented enough or sufficiently different to outperform the returns from the share market.

— Duncan Burns,

Vanguard’s Chief Investment Officer Asia-Pacific

Most active funds have underperformed

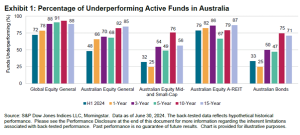

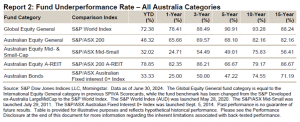

Over the six-month period ended 30 June 2024, a majority (54%) of actively managed funds across all Australian fund categories underperformed their assigned benchmarks.

More than 70% of Australian active managers with “Global Equity General” portfolios underperformed the S&P World Index’s total return of 14.9% in the first-half, posting an average asset-weighted return of 11.8%. Over the full year to 30 June that underperformance number was 78%.

It was a similar story for Australian active managers with “Australian Equity General” portfolios. While the underperformance over the six months to 30 June was lower at 48%, over the full 2023-24 year 66% of active investment managers failed to beat the total return from the broader Australian share market.

The underperformance numbers rise even higher over longer periods, as shown in the chart below.

Duncan Burns, Vanguard’s Chief Investment Officer, Asia Pacific, says the latest SPIVA results highlight the benefits of using index funds as the core of an investment portfolio.

“The latest S&P Indices versus Active (SPIVA) scorecard showing 66% of actively managed Australian Equity General Funds underperformed the Australian share market over the financial year to 30 June 2024, and 48% underperformed in the first half, is a dismal result.

“Over the last three financial years 70% of Australian Equity General Funds have underperformed their assigned benchmark, and that number rises to more than 80% after 10 years.”

“This isn’t just an Australian phenomenon. The global SPIVA scorecard shows 75% of U.S. active managers underperformed the S&P 500 Index over the first half, as did 73% of active managers against the S&P World Index.”

Active underperformance is driving investors to index funds

“What the SPIVA scorecard really highlights is that most active fund managers are not talented enough or sufficiently different to outperform the returns from the share market, which explains the rapid acceleration of investor inflows into index-tracking funds,” Mr Burns says.

“Put bluntly, Australian investors are increasingly voting with their feet because they’re realising that using an index fund to get the return from the share market is a much better alternative than using active managers that are highly likely to underperform the market.

“In Australia the bulk of investor inflows into exchange traded funds are continuing to be directed into index funds, which now account for more than 91% of total Australian ETF industry assets.

“We estimate there are now over 400 index funds including exchange traded funds (ETFs) in Australia managing around $750 billion.

“But that still only represents around 25% of total investment assets under management, whereas index funds account for 50% in the U.S. and 30-40% in Europe.

“There’s huge scope for Australian index funds, and frankly there are a lot of Australian investors who could improve their retirement and investment outcomes by dialling up their index exposure through index ETFs.”