How Vanguard’s low-cost revolution changed the game

By Vanguard

Investing strategy

Australian investors have saved over $15 billion in fees using low-cost index funds

The Vanguard Group was launched in May 1975 with an overriding mission to take a stand for all investors, to treat them fairly, and to give them the best chance for investment success.

For Vanguard’s founder, John C. Bogle, a core part of the mission was about lowering the costs of investing for everyday investors.

Often referred to as the “father of index funds”, he was a vocal advocate for the idea that high fees erode investor returns over time.

“Where returns are concerned, time is your friend. But where costs are concerned, time is your enemy,” Bogle wrote in his book, The Little Book of Common Sense Investing, referring to the increasing impact of higher costs over the longer term as investment balances rise.

In addition, he argued that while active portfolio managers aim to produce higher investment returns, the evidence overwhelmingly showed that most actively managed funds failed to outperform their benchmarks over the long term simply because of their higher fees.

“Investors need to understand not only the magic of compounding long-term returns, but the tyranny of compounding costs; costs that ultimately overwhelm that magic,” Bogle wrote later in The Clash of Cultures: Investment vs. Speculation.

Bogle’s trailblazing commitment towards lowering investment costs for investors has been the driving force behind a broad reduction in management fees over time, not just by Vanguard but right across the global assets management industry.

Vanguard research shows investors in Australian domiciled funds have collectively saved an estimated $15.3 billion since 1997 by investing in low-cost index funds.

A 50-year low-cost track record

Since its foundation 50 years ago, Vanguard has consistently applied a range of strategies to help lower the cost of investing around the world. These are detailed below:

Introducing index-based investing

Vanguard was the pioneer of index funds, which track the performance of specific market indices. Index funds, including many exchange traded funds (ETFs), are passively managed, which significantly reduces management fees and ongoing transaction costs.

Leveraging economies of scale

As one of the largest investment management companies in the world, Vanguard benefits from significant economies of scale. The company has been able to spread its fixed costs over a larger asset base, allowing it to offer lower expense ratios to investors.

Passing through efficiency gains

Vanguard operates with a focus on efficiency and cost control. The company invests in technology and operational processes that streamline its operations, reducing overhead costs. These efficiencies have been passed on to investors in the form of lower fees.

Improving transparency and fairness

Vanguard has always been committed to transparency in its fee structure. The company clearly discloses all fees and expenses associated with its products, allowing investors to make informed decisions. This transparency helps build trust and ensures that investors understand the costs they are paying.

Having a client-first culture

Vanguard’s corporate culture is centred around the principle of putting clients’ interests first. This client-centric approach drives the company to continuously seek ways to reduce costs and improve value for investors.

By implementing these strategies, Vanguard has been able to maintain some of the lowest expense ratios in the industry, making it a preferred choice for cost-conscious investors.

Australian investors have saved over $15 billion

Research by Vanguard’s Investment Strategy Group has estimated investors in Australian domiciled funds have collectively saved $15.3 billion since 1997 by investing in low-cost index funds including exchange traded funds (ETFs).

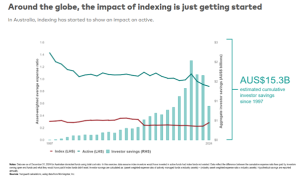

This reflects ongoing reductions over time in the asset-weighted expense ratios of Australian index funds, as shown in the chart below.

To calculate the amount investors have saved, Vanguard looked at the total assets held in index funds and multiplied this by the difference between active and index fund expense ratios for Australian domiciled funds.

Around the globe, the impact of indexing is just getting started

In Australia, indexing has started to show an impact on active.

Minimise your costs

When it comes to investing, every dollar you pay in costs is a dollar out of your future returns. If you focus on low-cost products it will help increase your results over time.

Returns are not consistent, but fees are. You’ll pay them, even when investment returns turn negative.

While a few percentage points may not sound a lot, they will add up to thousands of extra dollars in fees on larger investment amounts and over longer periods of time.

By focusing on cost efficiency, Vanguard aims to empower investors to achieve better long-term returns, ultimately fulfilling the Bogle vision of a more equitable and accessible investment landscape.