Why it’s important to stay the course during market volatility – in three charts

By Vanguard

Investing strategy

Staying the course is sage advice for long-term investors anxious about market volatility — and for good reason

By looking at how markets have performed over time, we can put current events into context and appreciate the benefits of a long-term and well diversified investing strategy.

The following three charts highlight the importance of staying invested and focusing on the long-term when markets are volatile.

Don’t let turbulence distract you: Keep your focus on the longer term

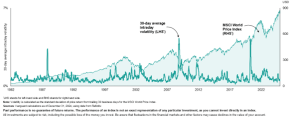

Volatility and index prices for the MSCI World Price Index (December 31, 1982, through December 31, 2024)

Short-term volatility has forever been part of investing. Extreme and extended cases of volatility have frequently coincided with market pullbacks.

But investors clearly would do well to focus on the long term as global equity returns as measured by the MSCI World Price Index would suggest.

This chart shows that, despite periods of high volatility that have coincided with market pullbacks, equity markets have climbed over the long term.

From December 31, 1982, through December 31, 2024, global equities faced several periods of extreme intraday volatility, most notably after the stock market crash of 1987, the global financial crisis in 2008, and the start of the COVID-19 pandemic in early 2020.

However, despite sharp market pullbacks that coincided with these periods of intraday volatility, global equities have produced strong results over the long term.

Downturns aren’t rare events: Investors will endure many of them during their lifetime

Global stock prices (January 1, 1980, through December 31, 2024)

Bear markets and corrections are inevitable for investors. Maintaining a long-term focus is the best way to navigate these challenging periods.

From January 1, 1980, through December 31, 2024, the average length of a bull market in global equities has been nearly four times that of a bear market.

It’s worth noting that although the downturns that began in August 1987 (related to Black Monday) and February 2020 (related to the start of the COVID-19 pandemic) don’t meet a widely accepted definition of a bear market because they lasted less than two months, we are counting them as bear markets and including them in our analysis because of their historic nature and the magnitudes of their declines.

Longer holding periods reduce the chances of a negative return

Historical probability of negative return for various holding periods

The longer you stay invested, the less the historical likelihood that you’ll earn a negative return.

Over a 10-year holding period, investors holding a portfolio of 60% US stocks and 40% high-grade US bonds haven’t had a negative nominal return (not accounting for inflation) and have had significantly less likelihood for negative real returns (accounting for inflation) compared with shorter holding periods. As always, past performance is no guarantee of future returns.

Many investors think of cash and equivalents like US Treasury bills as safer than equities.

But when adjusted for inflation, US Treasury bills have been more likely than stocks to have negative returns.

Focus on what you can control

At Vanguard, we believe investors should focus on the things they can control.

That means setting clear investment goals, ensuring your investments are low-cost and diversified (both geographically and across asset classes), and staying focused on the long term.

Important Information

All investing is subject to investment and other known and unknown risks, some of which are beyond the control of Vanguard, including possible delays in repayment and loss of income and principal invested. Please see the risks section of the Product Disclosure Statement (“PDS”) for the relevant financial product for further details. Neither Vanguard Investments Australia Ltd (ABN 72 072 881 086 AFSL 227263) nor its related entities, directors or officers give any guarantee as to the success of the investment, amount or timing of distributions, capital growth or taxation consequences of investing.

This article contains certain ‘forward looking’ statements. Forward looking statements, opinions and estimates provided in this article are based on assumptions and contingencies which are subject to change without notice, as are statements about market and industry trends, which are based on interpretations of current market conditions. Forward-looking statements including projections, indications or guidance on future earnings or financial position and estimates are provided as a general guide only and should not be relied upon as an indication or guarantee of future performance. There can be no assurance that actual outcomes will not differ materially from these statements. To the full extent permitted by law, Vanguard Investments Australia Ltd (ABN 72 072 881 086 AFSL 227263) and its directors, officers, employees, advisers, agents and intermediaries disclaim any obligation or undertaking to release any updates or revisions to the information to reflect any change in expectations or assumptions.