Why the cash rate is being kept on hold

By Tony Kaye, Senior Personal Finance Writer

Markets and economy

The RBA is unlikely to start easing interest rates until the second quarter of 2025.

“The board needs to be confident that inflation is moving sustainably towards the target and we need to see more progress on underlying inflation coming down.”

That was the bottom line from Reserve Bank of Australia (RBA) Governor, Michele Bullock, last week in justifying the central bank’s decision to keep its policy cash rate on hold at 4.35%.

Furthermore, she noted that Australia’s underlying inflation is forecast to be in the top of the RBA’s 2-3% target range by the end of 2025, and to the midpoint of the band by the end of 2026.

“Right now we believe settings are restrictive and we need to keep rates restrictive for the time being,” she said. “We’re watching the data closely and we’re not ruling anything in or out. We do think that there are still some risks on the upside.”

To tame inflation, a prolonged period of subdued demand will be necessary, weakening economic growth.

— Grant Feng,

Vanguard Senior Economist

Unlikely near-term rate cut

Vanguard Senior Economist, Grant Feng, says that despite slowing economic growth, core inflation remains elevated, and Australia’s labour market remains tight.

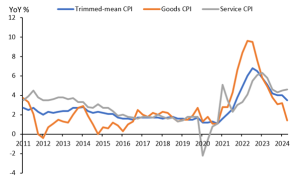

“The September quarter Consumer Price Index was largely in line with expectations, with trimmed-mean inflation increasing by 0.8%, despite utility subsidies helping to reduce headline inflation to a modest 0.2% increase over the quarter” Dr Feng says.

“In our view, while some housing and goods related inflation is showing signs of easing, this deceleration is gradual. Services inflation remains particularly resilient, bolstered by steady increases in administrative costs, which suggests that trimmed-mean inflation will stay above the RBA’s target range in the near term.

Figure 1: While subsidies and fuel have assisted headline disinflation, services has shown no disinflation this year.

Source: Vanguard

Figure 2: Measures of labour market capacity are off peak tightness but have not loosened much this year.

Source: Vanguard

Although the RBA’s aggressive rate hikes totalling 425 basis points since 2022 has depressed household spending and weighed on growth, other factors have partly offset this effect.

“First, the surge in inward migration since Australia’s reopening after COVID has driven aggregate demand higher, and although the pace of migration is now slowing, it remains above historical averages,” Dr Feng says.

“Second, government spending has played a substantial role in supporting economic and employment growth, a trend that’s likely to continue ahead of the federal election scheduled for Q2 2025.

“Fiscal policy has thus become expansionary at a time when the RBA continues to maintain tight monetary conditions to curb inflation.

“Moreover, weak productivity growth has constrained the economy’s supply capacity, underpinning unit labour costs that are inconsistent with the RBA’s inflation target.”

Dr Feng says aggregate demand is consequently likely to exceed aggregate supply, keeping the labour market historically tight and the economy operating close to, or slightly above, full capacity.

“In light of these dynamics, we expect the RBA to be slow in pivoting toward policy easing,” he says.

“To tame inflation, a prolonged period of subdued demand will be necessary, weakening economic growth.

“Our base case is the RBA will not enter the easing cycle until the second quarter of 2025, with a gradual and slow pace to follow.

“A focus on the supply side, especially on labour productivity, would be a key help for the RBA in disinflating the economy while also lifting Australia’s long-term growth potential.”

Dr Feng says it would be less painful to achieve disinflation with lower disruption to demand and the labour market.

“However, Australia has shown the weakest productivity growth among comparable developed economies since the pandemic,” he says.

“Without significant improvements on the supply side, demand will likely need to remain suppressed for an extended period to bring inflation in line with the RBA’s target.”